Good governance

All candidates on one stage in Chuadanga: a rare vow for good governance, accountability

Breaking away from the usual combative rituals of electioneering, all contenders for Chuadanga-1 constituency came together on a single stage on Wednesday, facing voters directly and pledging accountability, transparency and corruption-free governance.

Three rival candidates -often divided by ideology and party lines—sat side by side, listened to voters’ concerns and answered pointed questions.

More strikingly, they went beyond campaign promises, jointly signing a stringent 15-point written pledge committing themselves to clean, people-centric governance if elected.

The event, titled “Face to Face with the People”, was organised by Shujan, Chuadanga district unit, at the open stage adjacent to the Water Development Board in the town.

On stage were BNP-nominated candidate Md Sharifuzzaman Sharif, also general secretary of the district BNP; Jamaat-e-Islami nominee Advocate Masud Parvez Russell, assistant secretary of the district Jamaat; and Islami Andolon Bangladesh candidate Zahurul Islam Azizi.

Despite sharp ideological differences, the three candidates spoke in one voice on several issues, promising to turn Chuadanga into a district free from terrorism, drugs and tender manipulation.

Presided over by Professor Siddiqur Rahman, former principal of Chuadanga Government College and president of Shujan’s district unit, the programme was moderated by journalist Meherabbin Sanvi, the organisation’s district facilitator.

Ignoring the winter chill, more than 450 voters from different parts of the district joined the dialogue, voicing expectations and frustrations—from unemployment and farmers’ fair prices to law and order and political intolerance.

Sharifuzzaman Sharif said he envisioned Chuadanga as a modern, secure and inclusive region. “Standing before you today, I pledge that if elected, I will work to make Chuadanga free from terrorism, drugs and extortion,” he said.

1 month ago

Good governance, reforms take time: Shafiqul Alam

Chief Adviser’s Press Secretary Shafiqul Alam on Saturday (8th November 2025) said good governance and reforms cannot be achieved overnight, noting that in some countries such reforms took more than a decade of discussions.

Addressing a programme organised by the Citizen Platform at a city hotel on Saturday afternoon, he said the national election would be held in the first half of February as the Chief Adviser and other advisers are actively working to ensure it.

“There’s no uncertainty about the election. Discussions on reforms may take place afterward,” he said.

Regarding the voting system, Shafiqul Alam said if political parties fail to take a decision, the interim government will make one.

Responding to criticism that farmers, women and workers were not consulted on the July Charter, he questioned, “Don’t political parties represent these people?”

Misinformation big threat to democracy: Shafiqul Alam

Shafiqul also urged political parties to take a clear stance regarding ousted Prime Minister Sheikh Hasina.

“Everyone must make their position clear. Sheikh Hasina again said today that those who took part in the July movement are terrorists. Awami League wants to return to power by branding 180 million people as terrorists and committing killings in the name of fighting terrorism,” he said.

The Press Secretary said creating jobs in the country will be a major challenge for the next government as artificial intelligence is reshaping the job market everywhere.

Mentioning that revamping development projects will also be a challenge, Shafiqul said, “Five billion dollars have been invested in railway projects — all of which somehow connect to Gopalganj. These were done under Sheikh Hasina’s corrupt system.”

Read more: Govt watching Hasina’s actions; she’s Bengal's ‘butcher’: Press Secretary

3 months ago

Bad loans must be cut to ensure good governance in banks: Speakers

Economists, researchers and academics have emphasised curtailing non-performing loans to ensure good governance in the banking sector and make the country's economy vibrant.

They also said that growing non-performing loans create challenges for banks and the economy of the country while global trate war is pushing the world towards chaos.

They made the remarks in a session on the 2nd day of ‘10th Annual Banking Conference-2025, organised by Bangladesh Institute of Bank Management (BIBM) at its Mirpur office.

Professor Dr. Barkat A Khoda was keynote speaker at the inaugural session of the second day.

Several sessions including FinTech and Financial Sector, Islami Banking and Governance, Risk Management and Bank Performance were held on the 2nd day.

The conference sessions cover contemporary issues and sustainability concerns on banking, finance and the economy both in the national and international context.

Speaking at an event Dr. Shah Ahsan Habib, senior Professor of BIBM said that the global economic and financial landscape is undergoing unprecedented transformation.

Bad loans in banking sector hits Tk6.75 lakh crore: White Paper

“We are witnessing a paradigm shift, a new wave of economic nationalism, protectionism, and currency uncertainty that is challenging for the foundation of the International Monetary Order,” he said.

The economy in today’s context reminds us of a long-gone yet defining period in economic history: ‘Interwar Period’ or the period between the First and Second World War. That time was marked by suspended gold convertibility, monetary fragmentation, and the notorious “beggar-thy-neighbour” policies, he pointed out.

“We know that Beggar-thy-neighbour policies were the economic strategies where a country tries to improve its own economy at the expense of others, often through tariffs or currency devaluation, so we have to prepare for any such previous situation,” he added.

He said that the leading economies were engaged not with cooperation, but with tariffs, trade barriers, and exchange controls now. In conséquences, a great economic depression like 1930 could be repeated. So there is need to prepare for a bad situation.

Md. Sabur Khan, chairman, Daffodil International University, Mohammad Abdul Mannan, chairman, First Security Islami Bank, Dr. Mahmood Osman Imam, Professor and dean, Business Studies, University of Dhaka chaired different sessions of the event on Thursday.

Around 1000 officials of different banks, economists, academicians and panelists participated in the two days session of the conference.

IMF voices concern over rising bad loans in banks

The annunal conference has been thr hallmark of BIBM since 2012. The two- day event brings together experts, academicians and researchers from all over the world to exchange and share knowledge, experience and research outputs on banking and related issues.

10 months ago

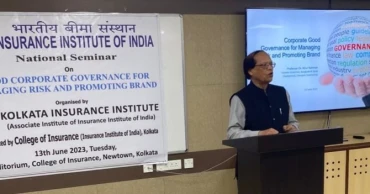

Corporate good governance should be a part of our life: Dr Atiur Rahman

Economist Dr Atiur Rahman said that corporate good governance should be a part of life, not the expectation, which will be a source of value creation for any of the entities in the private and the public sectors.

He said not only in the financial sector, but corporate good governance is also essential for all kinds of enterprises to extend the industrial revolution.

Former Bangladesh Bank Governor Dr. Atiur said this at a seminar in Kolkata organised jointly by the Insurance Institute of India and Kolkata, Insurance Institute on Tuesday (13 June 2023).

Also Read: ICCB calls for good governance to ensure international compliance

Presided by Basant Kumar Naik, Principal of the Institute of Insurance in Kolkata the seminar was attended by Babu Paul, General Manager, National Insurance; Miss Y. Lama, an insurance expert; Professor Konika Chatterjee, Department of Commerce, Calcutta University; and faculties, students, and experts from financial sectors.

“Customer trust is the foundation of good governance of any organization. They want delivery and not empty promises,” Dr Atiur said.

Also Read: Lawyers can play a big role to ensure good governance: President

Again, if they don’t get the promised services, they must be provided with a customer interest protection mechanism to redress their grievances, he pointed out.

The long-term sustainability of the organisation depends largely on corporate good governance, which thrives on the execution of well-set-out rules and procedures of the board with enough competent independent members, he said.

Also Read: Proposed amendments to banking act don’t go far enough in quest for good governance: Experts

Dr. Atiur said that knowledge management and human resource management are pivotal to good governance. And for up-to-the-mark knowledge management- there is no alternative to ensuring exchanges between national, regional, and international peers.

He urged that such discourses and exchanges must be facilitated so that governance practices can be revisited and augmented on a regular basis.

2 years ago

Ensure depositors’ trust and good governance in banks: Economists say at CPD discussion

Economists, during a discussion today, said the country’s banking sector is under threat due to lack of trust and good governance in banks.

Certain groups are influencing Bangladesh Bank’s regulatory decision-making, which is alarming for the economy, the economists added.

They made the observations at a discussion on ‘Managing the Economic Crisis’, organised by the Centre for Policy Dialogue (CPD), at a Dhaka hotel on Saturday.

Minister Abdul Mannan attended the event as chief guest while Professor Dr Rehman Sobhan presided over the function.

Former governor of Bangladesh Bank Dr Salahuddin Ahmed; economist Dr Ahsan H. Manur; former Chief Economist of World Bank’s Dhaka Office Dr. Zahid Hossain; Professor Abu Ahmed; Barrister Shamim Haider Patwari, Member of Standing Committee on Ministry of Law, Justice and Parliamentary Affairs; Rupali Haque Chowdhury, Managing Director, Berger Paints; Kamrul Islam, secretary of Bangladesh Garment Workers Solidarity, also spoke at the function.

Dr Salehuddin said, “If Bangladesh Bank can handle policy implementation rigorously, including defaulted loan collection, I believe the situation will improve.”

“But the central bank has to take the right policy independently, not look at anyone's face, as the current economic situation demands it,” he added.

Read more: Stick to global lending sources for long-term, low-interest loan, CPD tells govt

Any delayed decision of Bangladesh Bank, and the situation will worsen, he said.

Citing an example, he said the total volume of non-performing loans (NPLs) has increased by more than three times in the last 10 years since 2012.

The NPLs increased over Tk 1.34 lakh crore in the first quarter of the fiscal year 2023 from Tk 42725 crore in the fourth quarter of FY2012, as per a report of the central bank, he said.

He said the economy is standing at a point where it has to have proper reforms or be ready to see its collapse.

Executive Director of Policy Research Institute, Dr Ahsan H. Mansur, said deposits in the Brac Bank grew 27 percent in the last month as people are looking for good banks for the safety of their money. “So, trust and good governance can save a bank.”

He said that rigorous and exemplary punishment for loan scams is needed to gain people’s trust, appointing an observer is not enough.

Dr Zahid said the inflation is not created by external effects, domestic demand and GDP is growing, it does not match with the economy.

CPD Executive Director Dr Fahmida Khatun placed a report titled "Managing the Economic Crisis: CPD's Policy Recommendation" at the event.

"Actual NPLs will be much higher if loans in special mention accounts, loans with court injunctions, and rescheduled loans are included," the report said.

Read more: No need to hike fuel price if BPC’s corruption and mismanagement end: CPD

The CPD mentioned that appointments of bank directors based on political connections, loans sanctioned on political grounds, rescheduling of loans despite poor record of repayment, and writing off loans to reduce the tax burden and clean balance sheets of banks are among the reasons behind the high volume of NPLs in the country.

Besides, the weak internal control and compliance risk management of banks, lack of independence of Bangladesh Bank, dual regulation by the Financial Institutions Division and the central bank, and flexibilities given to defaulters by the central bank are also responsible for the high volume of the NPLs, it said.

3 years ago

Banks must operate in compliance & good governance: BB Governor

Bangladesh Bank governor Abdur Rouf Talukder said that banks must comply with rules in debt management and other activities assuring that the central bank will ensure good governance in the banking sector.

The governor was addressing the media at Jahangir Alam Conference Hall at Bangladesh Bank Bhaban on Thursday, his second meeting with journalists after assuming office on July 12.

The central bank, meanwhile, identified the weak banks and it plans to talk to them one-to-one basis. These banks will get a three-year business plan for improvement under direct observation of Bangladesh Bank, he said.

Failure in one bank would affect other banks and financial institutions. So, it is better to improve banks by good governance, he pointed out.

The central bank has already assured banks’ managing directors (MDs) and chief executive officers (CEOs) of support regarding good governance, he said.

Deputy Governors Ahmed Jamal, Kazi Sayedur Rahman, A.K.M Sajedur Rahman Khan, Abu Farah Md. Nasser, BFIU chief Masud Biswas, executive director (ED) and chief economist Habibur Rahman, ED and spokesperson Md Serajul Islam, and senior officials were present at the event.

Rouf said the central bank has taken essential policy measures for a stable exchange rate, increasing the supply of dollars, curtailing unnecessary luxury imports and increasing vigil in the exchange market.

But, it will take time to get results, he said. “We should be patient.”

Ruling out raising the lending interest rate, the governor said that the BB prefers demand cut, imposing higher taxes to curb the inflation rate in the domestic economy due to external effects.

Read: FY23: Bangladesh Bank raises agro credit target to Tk30,911 crore

He also hinted at strengthening the bond market along with enhancing the equity supply in the stock markets.

Reply to a query Rouf said banks have to ensure compliance in each sector and serve every citizen, influential or ordinary.

Regarding the current account deficit, the governor said, “Our economy is heavily import-oriented. Fuel oil, gas, edible oil, food and even over 60 per cent raw materials for export-oriented industries are imported. This created an imbalance or deficit.”

The BB’s chief economist Habibur Rahman gave a presentation on different policy measures that have been taken by the central bank recently to stablise currency and money flow.

The BB sold USD $ 7.4 billion in the FY2021-22 to keep foreign exchange supply smooth. The BB bought $7.7 billion from banks in FY 21 due to keeping a stable forex exchange rate.

The licenses of 10 exchange houses have been cancelled and notices were sent to another 45 houses to explain their transaction report and alleged violation of money exchange rules.

The BB has increased the interest rate on non-resident foreign currency deposits (NFCD) and benchmark (Eurocurrency deposit rate) by an additional 2.25 and 3.25 per cent to attract more foreign currency deposits.

3 years ago

President Hamid urges transparency in govt activities

President Abdul Hamid on Sunday called for establishing transparency and accountable good governance in government activities to make democracy more effective.

"Democracy needs to be made more effective ...... by ensuring proper participation of the people in all government activities," he said addressing thecParliament in the New Year's first session.

This was also the 16th session of the 11th parliament.

The president said that the government’s expenditure has increased due to huge increase of government’s development activities over the past one-and-a-half decade.

He also urged to maintain caution in all matters related to projects to prevent misuse of government funds.

Read:Islamic Front and NAP discuss formation of EC with President Hamid

"It is necessary to ensure 100 percent implementation of the project by adopting time bound action plan,” he added.

According to the constitution, the president addresses the House in the first session of New Year highlighting progrmmes and achievements of the government.

The president’s speech was approved earlier by the cabinet.

Mentioning people as the source of all power the President urged the legislators to keep public interest over everything else.

Hamid called upon members of the treasury and opposition benches to play their due role in the House.

The president called for building national conference on basic issues of democeacy. rule of law and development.

He said the new generation should be gifted a safe, happy, beautiful and prosperous Bangladesh as dreamt by Father of the Nation Bangabandhu Sheikh Mujibur Rahman.

He said peace and stability is prevailing in the country due to the zero tolerance policy of the government against terrorism and militancy,

He said that the government is trying to ensure that people from all communities of the country can practice their religion in harmony while religious festivals of all communities including Muslims, Hindus, Buddhists and Christians are celebrated peacefully in a solemn and festive atmosphere.

4 years ago

AL, BNP failed to ensure good governance: GM Quader

Jatiya Party Chairman GM Quader on Tuesday said the country’s people now eager to see his party in power as the two major parties--Awami League and BNP--have failed to ensure good governance during their rule.

5 years ago

‘One-party rule’ on its way out: Oli

President of Liberal Democratic Party (LDP) Oli Ahmed on Sunday placed a 22-point proposal for’ restoring’ peace and good governance in the country as he expects the ‘one-party rule’ will end very soon.

5 years ago

Lack of rule of law behind rise in crimes: GM Quader

Jatiya Party Chairman GM Quader on Monday said the incidents of killing, rape and injustice and misdeeds are on the rise in Bangladesh for lack of the rule of law and good governance.

5 years ago

.jpg)