loan repayment

Repayment of Padma Bridge loan starts with Tk 316.91 crore given to govt

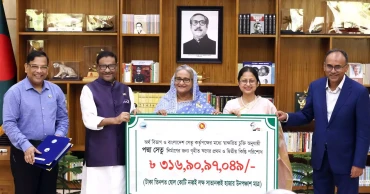

The repayment of the loan taken for construction of Padma Bridge started with Tk 316.91 crore paid to the government in the first two installments on Wednesday.

Prime Minister Sheikh Hasina received a cheque of Tk 316,90,97,049 as the first and second installments of the loan.

Road Transport and Bridge Minister Obaidul Quader handed over the cheque to the premier at her official residence Ganabhaban.

The loan was taken from Bangladesh Bank at a low interest rate under an agreement signed between the Finance Division and the Bangladesh Bridge Authority.

Speaking on the occasion, the prime minister said the country will continue to march ahead overcoming any barrier and disaster.

“Bangladesh will continue to march forward, maintaining the current pace of its development journey, no matter how many obstacles come,“ she said.

The PM sought cooperation from the whole nation to face any disaster, accident, the brunt of the war or inflation as the people in cities and villages did during the construction of the Padma Bridge.

"I believe we can move forward overcoming any hurdle if the people stand beside us. Construction of the Padma Bridge with the own finance is the best example of it," she said.

She said the government had to overcome a strong obstacle nationally and internationally during the construction of the iconic bridge.

PM Hasina said she didn’t get support from a number of people regarding the construction of the country’s longest bridge with own finance. It was said that it would never be possible, she said.

She said different heads of the state and government during talks told her that it would be a tough work since the World Bank withdrew its finance from the project. But only Malaysia supported with then Malaysian Prime Minister Najib Abdul Razak saying that it would be possible with own finance, she noted.

Describing the Padma Bridge as the sign of the country’s pride, she said Bangladesh has been able to show its capacity to the world with the construction of the bridge with own finance.

“I think it’s not only a bridge, but also a symbol of pride and capacity of the Bengali nation,” she said, adding that the trial run of train through the Padma Bridge also started from Tuesday last.

On June 25, 2022, the prime minister opened the country’s largest bridge – 6.15-km Padma Bridge- over the mighty Padma River.

The 6.15-km bridge connected directly the country’s 21 south and south-western districts with the capital, and it is expected to accelerate the GDP growth by 1.23 per cent and make an outstanding contribution to socio-economic development by alleviating poverty.

The total allocation was Tk 30,193.39 crore, but the allocation for the main bridge was Tk 12,133.39 crore (including Tk 1,000 crore for installation of 400-kv electricity transmission line and gas line).

Besides, the Tk 9,400 crore was allocated for river training works, Tk 1,907.68 crore for approach roads (including two toll plazas, construction of two buildings for police stations and three service areas), Tk 1,515 crore for the rehabilitation of the displaced people (caused by the project) and Tk 2698.73 crore for land acquisition.

The Padma Bridge is expected to last more than 100 years, but its construction cost will be recovered in the next 35 years.

PM’s Principal Secretary M Tofazzel Hossain Miah conducted the cheque handing-over event, while former Cabinet Secretary and Bridge Division Secretary Khandker Anwarul Islam spoke on the occasion.

Governor of Bangladesh Bank Abdur Rouf Talukder, Finance Senior Secretary Fatima Yasmin, Bridge Division Secretary Md. Monjur Hossain were present at the event.

2 years ago

BB relaxes loan repayment for NBFIs

Bangladesh Bank (BB) on Wednesday (December 21, 2022) relaxed term loan repayment policy for non-bank financial institutions (NBFIs) after relaxing such policy for banks’ borrowers.

The borrowers would not be declared as defaulters if at least 50 percent of the installments are paid as of September, according to a notice of the central bank.

The rest of the installments could be repaid on a monthly or quarterly basis within one year after the current repayment schedule of the loan.

Read more: BB relaxes ICRRS to facilitate businesses’ loan

The loan repayment relaxing policy would also be applied for the funding in investment of shariah-based financial institutions. If borrowers fail to repay the loans, lease and investments within the new repayment schedule, they would be classified as per rules, the BB notification said.

The circular stated that the NBFIs are facing difficulties in realising installments on time as the cash flow to SMEs and large enterprises has been affected by the Russia-Ukraine war and global recession.

Read more: BB extends tenure of relaxed ‘risk-weighted’ funding in new investment

3 years ago

Bank borrowers’ repayment relaxed until June 30

Bank borrowers can repay their loans until June 30 instead of the earlier deadline of March 31 without being defaulters.

A Bangladesh Bank circular, issued on Tuesday, gave this relaxation to the bank borrowers.

Also read: BB further relaxes loan repayments to financial institutions

It said the measure was taken considering the negative impact of coronavirus on Bangladesh's economy.

In the existing situation, those who will face trouble in repaying their loan installments by March 2021, can make their repayments until June 30 on the basis of bank-client relation.

Also read: BB relaxes loan repayment method for coronavirus

“In this case, their loans would not be classified,” it said, adding that other policies will remain applicable in case of calculating the loans, lease, interest on advances and profits while no penalty interest or extra fee will be charged.

4 years ago

BB further relaxes loan repayments until Dec 31

Bangladesh Bank has further extended its relaxed conditions for loan repayment till December 31 taking into consideration the impact of coronavirus on the country’s trade and business.

According to a circular issued by the central bank on Monday, classification of loan will not be changed between January 1 and December 31 this year even if anyone failed to pay back the loan as per the schedule.

Earlier, the facilities were applicable until June 30 and then extended until September 30 through a similar circular issued on June 15 this year.

The new circular, issued by its Banking Regulation and Policy Department (BRPD), said businesses in Bangladesh were affected like other parts in the globe due to the coronavirus outbreak.

It is assumed that many loan recipients may not be able to repay their loans as per the schedule, it said.

In such a situation, there is an apprehension that the trade and businesses might be affected and the overall employment might be impeded.

Considering the situation, this was decided that the classification of any loan will remain unchanged until December 31 and will be treated as it was from January 1, mentioned the BB circular.

But if the classification of the loan is improved, it could be upgraded by this time, it added.

The directive was issued in a circular sent to the chief executives of all scheduled banks.

According to the new guidelines, the borrower will not be considered as a defaulter even if he does not pay any installment from January 1 to December 31 this year.

No penalty, interest or additional fee (whatever the name may be) may be levied on the loan / investment during this period.

Rational rebate facility can be provided by the bank to encourage the customer to repay the term loan (including short term agricultural loan and micro loan) in installments voluntarily and to repay the loan, said the BB circular.

Also read: Bangladesh Bank suspends interest on bank loans for April-May period

5 years ago

Govt to pay Tk2256.7 bln as loan interest in three fiscals

The government will pay an estimated Tk 2,256.7 billion as interest on loans in the next three fiscals including the current one.

5 years ago

BB extends relaxed loan repayment until Sept 30

Bangladesh Bank has further extended its relaxed loan repayment system until September 30 taking into consideration the impact of coronavirus on the country’s trade and business.

5 years ago