NRB

Buying US Dollar Investment Bonds: A Comprehensive Guide for NRBs

When it comes to investments, bonds offer some of the best-secured opportunities out there. As a part of investment facilities through bonds for non-resident Bangladeshis (NRBs), Bangladesh Bank offers US Dollar investment bonds (USDIB). Let's take a detailed look at who this is for, how to apply, and what are the benefits of the bond.

What is a US Dollar Investment Bond?

The US Dollar Investment Bond was first introduced in 2002 as a form of investment opportunity for the NRBs. The key goal was to maintain economic stability and increase foreign reserves by attracting dollar investments. It also provided a secure pathway for the NRBs to invest and gain from their foreign earnings.

The rules for the USDIB were later updated in 2012 where the invested principal and the interest can be repatriated in dollar or taka as per the choice of the investor.

Read more: How to Invest in Bonds: A Comprehensive Guide

Who is Eligible for USDIB?

The government of Bangladesh outlined the eligibility criteria for USDIB investment as follows:

Any NRB living and working abroad earning in foreign currency.Foreign nationals of Bangladeshi origin living abroad and earning in foreign currency. Government and semi-government employees working abroad and earning in foreign currency. This includes those working in Bangladeshi missions or international organizations.

How to Buy USDIB?

The process of buying USDIB starts with opening a foreign currency account in any designated bank that operates USDIB under Bangladesh Bank. Note that the F.C. account is different from the Non-Resident Investor’s Taka Account (NITA) as the investment currency can only be US dollars in this case.

Step 1: Opening a Foreign Currency Account

Almost all the leading commercial banks (both national and private) offer USDIB under their NRB banking services. To open a foreign currency account, an NRB would require the following documents.

- Prescribed Account Opening Form - Two passport-size photographs of each of the account holder and the nominee - Authorized specimen signature card (attested by the Bangladesh Embassy in the residing country) - Proof of employment - Copy of passport (attested by the Bangladesh Embassy in the residing country)

An NRB can easily open the F.C. account in any foreign branch of the available banks or use the mail-in service to open the account in Bangladesh.

Read more: Top 10 Strongest Currencies in the World as of May 2024

Step 2: Document Required for USDIB

The process of applying for USDIB differs from bank to bank. Generally, the following documents are required.

- Bangladesh Bank application form for USDIB (https://fid.portal.gov.bd/sites/default/files/files/fid.portal.gov.bd/forms/4085d5c1_fd59_4be6_921d_c2c491fce6dc/investment.pdf)- Application request to invest in USDIB in the respective bank - Personal declaration form - FATCA form (for NRBs residing in the USA)

Step 3: Applying for USDIB

Once you apply for USDIB, you will need to show equivalent funds in your foreign currency account associated with the bank. The money can be deposited in the F.C. account in one of the following ways:

- Cash foreign currency deposited at an NRB branch of the bank- Traveler cheques - Regular cheques or drafts - Money order receipt - Electronic fund transfer - Once the bank completes the due diligence, it will issue bond scrips against the desired amount of bonds to be purchased.

Read more: How to Buy Bangladesh Government Treasury Bond: Everything You Need to Know

1 year ago

BGMEA honors non-resident Bangladeshis with NRB Award

Omar Ishrak, Chairman of the Board of Directors at Intel, Mohammed Mahtabur Rahman (Nasir), Chairman and Managing Director of Al Haramain Perfumes Group of Companies and the Chairman of NRB Bank Limited, and Kiswar Chowdhury, one of the grand finalists of MasterChef Australia, have been honoured with NRB Award.

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) has honored them in recognition of their contribution to brightening the image of Bangladesh abroad.

The awards were handed over to them at a grand ceremony organized by BGMEA as a part of the Made in Bangladesh Week at International Convention City Bashudhara in Dhaka on Wednesday.

Read more: BGMEA seeks uninterrupted energy supply by special arrangements

Mohammed Mahtabur Rahman was present at the award ceremony while Omar Ishrak and Kiswar Chowdhury joined the event virtually and received the awards through their representatives.

Salman Fazlur Rahman, MP, Private Industry and Investment Adviser to the Prime Minister, graced the ceremony as the chief guest.

Nasrul Hamid, MP, State Minister for Power, Energy and Mineral Resources, attended the ceremony as special guest while Faruque Hassan, President of BGMEA, chaired the award giving ceremony.

BGMEA has launched the first-ever NRB Award to recognize the role of non-resident Bangladeshis in the development of Bangladesh.

BGMEA President Faruque Hassan said, “It gives me great pleasure to honor the non-resident Bangladeshis (NRBs) who are upholding the good name of Bangladesh abroad and relentlessly striving to build a better Bangladesh although they are many borders away.

Read more: Bangladesh's RMG bracing for next phase of growth: BGMEA

They have selflessly contributed immensely to the development of their motherland by sending their hard-earned remittances, promoting Bangladesh abroad and bringing home knowledge and technology. Bangladesh thanks you.”

3 years ago

Remittance Magic: Bangladesh received $11.95bn in 7 months

Bangladesh received USD $ 1704.45 million ($1000 million is equal to 1 billion) in remittances in January 2022, which is $73.79 million more than December, 2021.

The Bangladesh Bank (BB) released the latest remittance update of inward remittances sent by the non-residents Bangladeshis (NRBs) through different banks. The remittance inflow got momentum through the legal channel in January as the government raised the incentive from 0.50 percent to 2.5 percent, insiders said.

Some banks also provided an additional 1 percent to attract remittance through the particular banks.

Bangladesh received $24.77 billion in the last 2020-21 fiscal year through the banking channel as the transaction through it came down due to international flight operation halted for Covid-19 pandemic.

READ: Central bank devalues taka to boost exports, remittances

The remittance inflow through the legal channel saw a decline in the current fiscal year as it got diverted to illegal channels, including hundi, after the global flight operation eased.

However, the overall remittance inflow is lower in the current financial year as compared to the previous year.

According to the central bank, Bangladesh received $11.95 billion remittance in the first seven months of the current fiscal year.

The expatriates sent $1871.49 million in remittances in July, $ 1810.10 million in August, $ 1726.71 million in September, $ 1646.87 million in October, $1553.70 million in November, $1630.66 million in December and $1704.45 million January of the current (FY 2021-22) year.

How remittance benefits Bangladesh

The inward remittance to Bangladesh has lifted many people from poverty and served as a cushion for families during difficult times, as the country saw during the pandemic.

According to economists, remittance has been the backbone of the National economy as it provides inputs in financing Bangladesh's trade deficit.

READ: Govt raises incentive on remittance to 2.5%

According to a recent study by the World Bank, remittance has helped to reduce the poverty level in Bangladesh by 1.5 percent.

4 years ago

Case filed by ACC against NRB Bank director and his wife

The Anti-Corruption Commission ( ACC) on Monday filed a case against Director of NRB Bank M Badiuzzaman and his wife Nasrin Zaman for misappropriating TK 2.53 crore.

The case was filed with the Dhaka Coordinated Office of ACC on Monday after the investigation.

READ: ACC files case against three people for misappropriation of govt funds

Deputy Director of ACC public relation office Muhammad Arif Sadeq told UNB that assistant director Saiduzzaman filed the case.

READ: ACC seeks wealth statements of 3 engineers, 3 others

According to the case statement, Badiuzzaman amassed an amount of TK 1.03 crore while another TK 1.5 crore was misappropriated in his wife's name.

4 years ago

Public, private sectors urged to hire NRBs to utilize their expertise

Speakers at a webinar urged the government and private sector entrepreneurs to hire the non-resident Bangladeshis (NRBs) in different projects offering them proper value and facilities to utilize their expertise.

They made the call at the virtual seminar titled: “Energy Sector HR Development:Can NRB Professionals Support?”, organised by Energy and Power magazine on Saturday.

They observed that foreign nationals are being appointed in many public and private projects at higher value. But NRBs, who have expertise on technical matters, are not offered with due value and facilities.

“If they are offered with proper value and due facilities, they would be interested to return home to utilize their expertise”, said Prof Dr M Tamim, eminent energy expert and special assistant to former chief advisor of caretaker government.

Dr. Tamim, also a professor of Bangladesh University of Engineering and Technology (BUET), expressed his resentment over the deteriorating situation in the educational institutions in the country in regard to expressing opinions on different technical issuers.

“We cannot discuss anything with an open mind. Universities are the places to discuss with open mind. But that places are being run with political identity”, he observed.

He said that experts have to think of political line while making opinion on technical issue. “Why don’t we talk in a transparent manner?” We have to bring change in this area”, he said.

The virtual seminar was also addressed by expatriate Bangladeshis Prof Firoz Alam, Prof Jahangir Hossain, Prof Tapan Saha, Saleque Sufi, and Power Cell Director General Mohammad Hossain while Energy and Power editor Mollah Amzad Hossain conducted the function.

Dr Tamim said Bangladesh’s education sector is also lagging behind in producing quality graduates as the local industry owners don’t find right candidates when they try to recruit from locally educated persons.

He said BUET has taken a programme to make a huge change in its educational structure to produce outcome-based market-oriented workforce.

“You will see a big change within next 2 years”, he added.

4 years ago

London to host Bangladesh Capital Market Fair in Oct

The Bangladesh Capital Market Fair (BCMF) has been scheduled to be held in London, home of the largest Bengali community outside of Bangladesh and West Bengal on Sunday, 10th October 2021.

5 years ago

38 NRBs to get CIP cards on Jan 6

38 non-resident Bangladeshis (NRBs) will receive the commercially important person (CIP) status on January 6 next year for their outstanding contribution to the country’s economy.

5 years ago

GD Assist to fly back NRBs to New York, Paris

GD Assist will fly back expatriate Bangladeshis and immigrant visa holders to New York and Paris on July 4 next by arranging special flight for the non-resident Bangladeshis (NRBs) who are currently staying in the country.

With support and approval of the Ministry of Foreign Affairs (MoFA) and Civil Aviation Authority of Bangladesh (CAAB), GD Assist is arranging operate special flight from Dhaka to New York and Paris for the expatriate Bangladeshis.

Many NRBs remain stranded in Bangladesh due to the suspension of air travel amid the coronavirus pandemic, said a release from GD Assist, a venture of Green Delta Insurance Company Ltd.

GD Assist, as the country's large healthcare management agency working in medical tourism for Bangladeshis, has been actively trying to facilitate return of these NRBs.

5 years ago

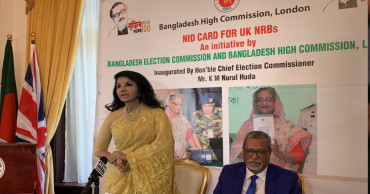

Bangladesh High Commission begins NID registration for NRBs in UK, Ireland

Bangladesh High Commission in London has started the formal registration of Bangladeshi expatriates in the United Kingdom and Ireland to provide them with the National Identity Card (NID).

6 years ago

.jpg)

.jpg)