national budget of 2021-22 fiscal year

Budget document: Preparations under way to face the challenges of developing economy

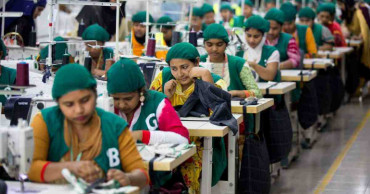

The government is preparing an action plan that will focus on helping the businesses to be more competitive in international export trade to face the new challenges after its graduation to a developing economy.

The plan, being prepared by the economic relations division, will include the strategies in the 8th Five Year Plan.According to a budgetary document, the government will continue to provide all possible policy supports to businesses and provide new forms of assistance as needed.

Read: Bangladesh's LDC graduation: Govt has its plan to face next challenges

The government has taken multiple steps to increase the overall competitiveness of the country's trade and commerce to survive in the international market by competing with products from other countries, according to the document. Bangladesh will have at least five years to deal with the challenges of transitioning from a least developed country to a developing country.According to the United Nations Capital Development Fund (UNCDP) recommendation, Bangladesh's transition will be effective in 2026. It means until 2026, Bangladesh will be able to enjoy all these benefits applicable to LDCs.However, under the current rules, Bangladesh will be able to enjoy duty-free and quota-free market access for another three years, i.e. until 2029, after entering the EU market.“During this period, traders in Bangladesh are expected to be able to improve their competitiveness in the international market,” Finance Minister AHM Mustafa Kamal said in his budget speech expressing his high hopes.Meanwhile, the government has taken various steps to address the challenges that Bangladesh will face as a result of its graduation from an LDC.The UNCDP upon the request of the government has recommended that against the backdrop of COVID-19 pandemic, the preparation period for the transition will be five years instead of three. During this period, that is, until 2026, all international facilities will continue.The LDC Group of the World Trade Organization (WTO) has put forward a proposal to ensure that all trade facilities pertaining to LDCs remain in force for another 12 years after transition.The document said that government has already taken steps to avail the advantage of GSP+ in EU countries after the graduation.Bangladesh on December 6, 2020 signed its maiden Preferential Trade Agreement (PTA) with Bhutan to boost bilateral trade between the two countries. Meanwhile, Bangladesh and Sri Lanka have agreed to sign a Preferential Trade Agreement (PTA) allowing duty-free access to a range of goods between the two countries and thus boost bilateral trade further.Initiatives have already been taken to sign preferential trade agreements 11 other countries.The government has taken effective steps to improve its ranking in the Ease of Doing Business Index to increase the flow of foreign direct investment (FDI).The benefits of these steps are becoming evident, the document reads.On the other hand, the government has already taken steps to set up 100 special economic zones, high-tech parks for technological advancement and implementation of various mega projects including the Padma Bridge, which will help create new jobs and increase national income.The government is also in discussion with development partners, trade partners and relevant international organizations will continue to ensure that some important international facilities remain available event after the graduation."Steps have been initiated to conduct sector-wise research activities on the opportunities created by the graduation and what can be done to meet the challenges," the document reads.

4 years ago

Obaidul Quader pleased by 'development-friendly' budget

Awami League General Secretary and Minister for Road Transport and Bridges Obaidul Quader acknowledged this year's 'development-friendly' budget.

He made the remarks in a budget reaction after the proposed budget was placed in the Jatiya Sangsad.

Read:BNP's budget reaction imaginary, traditional old story: Quader

Quader also said the proposed budget is 'realistic' and 'timely' to tackle the Coronavirus crisis with the assured participation of all the people of the country, and prioritising lives and livelihoods.

Read: AL wants increased allocation to ICT sector

The Tk 602,880 crore budget for 2021-22 fiscal, themed around "Priority on lives and livelihoods, tomorrow's Bangladesh," was placed before parliament on Thursday.

4 years ago

Vaccination for all to help achieve GDP target: DCCI

Dhaka Chamber of Commerce and Industry (DCCI) has said the country needs to control Covid transmission and ensure vaccination for all if the government wants to achieve the targeted 7.2 percent GDP in the proposed budget.

“Proposed budget is by and large inclusive and pro-people,” said DCCI President Rizwan Rahman thanking the government for reducing corporate tax both for listed and non-listed companies.

Read: DCCI for SME act, new definition of CMSMEs

He said it will help boost investment. But he suggested reducing it at a progressive rate of 2.5% in FY2022-23 and FY2023-24.

In its initial reaction, the chamber body President said the budget is a big one with an aim to economic recovery and effort to balance between lives and livelihood.

The proposed budget for FY2021-22 was announced on Thursday with a GDP target of 7.2% and inflation of 5.3%.

Read: Export diversification: DCCI for comprehensive trade policy

This year’s budget is 12.43% bigger than the revised budget of the last fiscal. In order to achieve the targeted GDP, all aspects of the economy have to perform better, which is challenging given the world-wide economic scenario, said the DCCI.

The budget tried to keep a balance between lives and livelihood, it said but the government may rethink the revenue target as it would be a great challenge to implement such a big budget considering the overall Covid situation.

The DCCI said the government has given importance to most of the proposals of DCCI especially increasing time limit for income tax and VAT return, reducing corporate tax and other taxes, engaging government owned schedule banks in SME financing, reducing advance tax on import of raw materials, increasing expenditure in the health sector and more allocation in the social safety net aiming to employment generation.

In the proposed budget, mitigating revenue shortfall, financing and ADP implementation are the biggest challenge, it said.

Since the proposed budget is an expensive one, it is more or less reflecting an inclusive approach through its indication to increase investment, fiscal incentives to the businesses, increased allocation in the health and social safety net programme and focus on economic recovery, said the DCCI.

In some cases the proposed budget slashes tax rate which may fuel investment, said the DCCI President.

The proposed budget allocated an increased amount for health and social safety net measures, which is a good initiative but need to implement ADP in the health sector, he said.

The DCCI President urged to widen the tax net, collection of due taxes, tax collection at the district level and tax automation for more revenue collection.

Mandatory e-TIN for national savings, cooperatives and postal savings will increase tax, said the DCCI.

Proposed budget deficit is 6.2% of GDP which is acceptable, Rizwan said.

New industries like home appliances, light engineering , automobile, ICT got tax exemptions, which is good for industrialization, he said.

The DCCI also recommended creating a strong capital and bond market for long term financing.

Tax exemptions have been given to the private sector to invest in hospitals and clinics for 10 years, he hailed the decision.

The DCCI chief said the automobile industry especially for 3 and 4 wheelers will get a boost as for local manufacturers, they will get 20 years tax benefits.

He also requested to rationalize advance income tax on export oriented RMG, jute and jute goods, agro processing and API raw materials.

4 years ago

Budget deficit: Savings certificates, non-bank sources to be tapped for one-third of domestic financing

A substantial portion of the proposed 6.2 percent of GDP budget deficit in the next fiscal will be met from the local sources, where a total of Tk 37,001crore will be taken out from the savings certificates and other non-bank sources.

Finance Minister AHM Mustafa Kamal placed this outline while unveiling the national budget in parliament on Thursday giving a total estimated expenditure of Tk. 6,03,681 crore, which is 17.5 percent of GDP.

Read: Govt aims to rein in budget deficit back within 5% from next fiscal

He said the overall budget deficit for FY2021-2022 will be Tk 2,14,681 crore, which is 6.2 percent of GDP, up slightly from the last budget's 6.1 percent.

“Out of the total deficit, Tk. 1,01,228crore will be financed from external sources, while Tk 1,13,453 crore from domestic sources of which Tk. 76,452 crore , or two-thirds will come from the banking system, and the remaining third, Tk 37,001crore, from savings certificates and other non-bank sources.

He mentioned that the government has set the target for total revenue income in the fiscal year 2021-2022 at Tk 3,89,000 crore, which is 11.3 percent of GDP.

Read: Overall budget deficit Tk. 190,000 crore in 2020-21

“Out of this, Tk 3,30,000crore will be collected through the NBR sources while revenue from non-NBR sources has been estimated at Tk 16,000 crore and the non-tax revenue is estimated to be Tk 43,000 crore”.

4 years ago

Covid-19: Govt to vaccinate 25 lakh people each month

With a plan to bring 80 percent people of the country under the mass immunisation programme in phases, Finance Minister AHM Mustafa Kamal on Thursday said the government will vaccinate 25 lakh people each month.

He came up with the announcement while presenting the national budget for the 2021-22 fiscal year in Parliament.

Also Read: Bangladesh's request for vaccine doses under active consideration: Miller

“Plans have been formulated to vaccinate 80 percent of people in phases. In the first phase, people with risks will be vaccinated and 25 lakh vaccines will be given each month,” the minister said.

Referring to Prime Minister Sheikh Hasina’s recent announcement that the government will ensure free vaccination for all, Kamal said they will provide as much fund as it is needed to bear the expenses of procuring the required doses of vaccine. “We’ll make adequate allocation for this purpose in the budget.”

Also Read: COVID-19 vaccine: Bangladesh to get priority if China develops vaccine

He said the vaccination programme is being implemented at the field level through coordination between the Expanded Programme on Immunization (EPI) and the Communication Disease Control (CDC).

Kamal said the National Deployment and Vaccination Plan has been prepared under the EPI to protect the lives of people from Covid-19.

“The government procured 3 crore doses of Covishield vaccine of Oxford-AstraZeneca from the Serum Institute of India. In addition, 6.80 crore doses will be available from the Covax facility under the World Health Organisation for 20 percent of our population, that is, for 3.40 crore people. Out of this 1.06 lakh doses have already been received,” he said.

The minister said there are plans to buy vaccines from the governments of China and Russia, Pfizer Co. from the USA and Sanofi/GSK from France/Belgium. “Negotiations are at the final stage for procuring Sinopharm vaccine from China and Sputnik-V vaccine from Russia, and, if necessary, manufacturing the same in Bangladesh.

Meanwhile, 70 lakh doses of Oxford/AstraZeneca Covishield vaccine reached Bangladesh, and the governments of India and China gave 32 lakh doses and 5 lakh doses respectively of coronavirus vaccine as gifts.

The finance minister said the World Bank provided US$ 500 million for procuring vaccines and US$ 14.87 million for logistic support.

“Loan Agreement for US$ 940 million with the ADB to procure COVID vaccine is at the final stage. Alongside, there is a good possibility to receive support for vaccine procurement from the European Investment Bank and AIIB,” he added.

4 years ago

Budget: Road to Graduation: Finance Minister shares opportunities, challenges

Finance Minister AHM Mustafa Kamal on Thursday said Bangladesh's image in the outside world will brighten after the graduation to a developing economy, which will bring foreign investment and create jobs.

“Foreign investment will likely increase, which will lead to massive infrastructure development in the country, job creation, and improved living standards,” he said.

Also Read: Tk6 trillion budget in the works for 2021-22; govt eyes on capital expenditure

In his budget speech at Parliament, the Finance Minister said the graduation will increase the country's credit rating, which will enable Bangladesh to get low interest loans in foreign currency by issuing sovereign bonds.

He, however, said all the international opportunities that Bangladesh is currently enjoying as a least developed country will either be unavailable or be reduced in many cases after the transition from a least developed country.

These include: In the case of trade, duty-free and quota-free market facilities; exemption from patent protection to the pharmaceutical industry under the WTO's Trade Related Intellectual Property (TRIPS) Agreement; and subsidies on export products/industries will be reduced. Foreign loans and grants on concessionary terms will be reduced.

Also Read: Cabinet approves proposed budget for new fiscal

He said the graduation will also increase productivity and competitiveness in foreign trade, which will help increase export earnings.

The Minister said absence of benefits as a least developed country will create a kind of compulsion to export diversification, resulting in the creation of new export products and markets.

He said the product supply chain will be integrated and will create incentives and obligations to produce high value and high value added products.

The Minister said the massive increase in the demand for skilled manpower will create an opportunity to create a workforce suitable for the Fourth Industrial Revolution.

“It will be easy to move the country forward by implementing a unified and inclusive development strategy with all stakeholders, including development and trade partners, the private sector and civil society,” he said.

The Finance Minister said the government has taken various steps to address the challenges that Bangladesh will face as a result of its graduation from an LDC.

At the request of the government, the UNCDP has recommended that against the backdrop of COVID-19 pandemic, the preparation period for the transition will be five years instead of three.

During this period, that is, until 2026, all international facilities will continue.

The LDC Group of the World Trade Organization (WTO) has put forward a proposal to ensure that all trade facilities pertaining to LDCs remain in force for another 12 years after transition.

Bangladesh has actively participated in this process, and is continuing its efforts to get this proposal accepted, said the Finance Minister.

He said the government has already taken steps to avail the advantage of GSP+ in EU countries after the graduation.

Initiatives have already been taken to sign preferential trade agreements with Bhutan and sign similar agreements with 11 other countries, the Minister said.

The government has already taken steps to set up 100 special economic zones, high-tech parks for technological advancement and implementation of various mega projects including the Padma Bridge, which will help create new jobs and increase national income, he said.

4 years ago

Tobacco products to become more affordable: Anti-tobacco platforms

In a quick reaction to the proposed national budget of 2021-22 fiscal year, two anti-tobacco platforms – PROGGA and Anti-Tobacco Media Alliance (ATMA) on Thursday claimed that tobacco products will become more affordable in the upcoming fiscal year.

The proposed budget has kept the prices unchanged for low-tier cigarettes which constitute around 72 percent of the cigarette market. The per capita income of the country, however, saw a 9 percent increase since last fiscal year, they said.

Also Read: National Budget: Progga, ATMA for hiking tobacco goods

The anti-tobacco platforms sent their reaction to the media after Finance Minister AHM Mustafa Kamal started unveiling the proposed budget in Parliament in the afternoon.

The proposed budget, if implemented, will considerably reduce the real prices of cigarettes and encourage the poor and the youth demographic to get hooked on the deadly addiction of smoking.

The same goes for bidi and smokeless tobacco (jarda and gul) where the taxes and prices have also been kept unchanged. This would put the low income people, particularly women, into greater health risk.

Also Read: Budget: Prices of tobacco products up, gold down

If the proposed budget is finally passed, tobacco companies will be the only beneficiaries and the government will lose revenue opportunities.

Such a budget will only encourage tobacco business and ignore hundreds of thousands of deaths, impairment, massive socioeconomic and environmental damage this industry causes, they said.

The proposed budget has kept the prices of and taxes on low and medium categories cigarettes unchanged. The prices for 10 sticks of high and premium tier cigarettes have been increased by only BDT 5 (5.2 percent hike) and BDT 7 (5.5 percent hike), setting the prices at Tk 102 and 135 respectively.

The existing 65 percent supplementary duty has been unchanged. This means the prices of per stick high and premium tier cigarettes will go up by only 50 paisa and 70 paisa respectively, which is a very negligible increase compared to the increase in per capita income.

On the contrary, due to faulty tax structure, tobacco companies will pocket a sizable portion of this increased price, and thus they will be encouraged in death trade, which is quite alarming.

However, if the government imposed tiered specific supplementary duty as demanded by anti-tobacco organizations, it would have generated additional revenues of BDT 3400 crores, which could have been used to deal with the losses related to coronavirus pandemic, said the platforms.

Bidi and smokeless tobacco (jarda and gul), known enemies to public health, have seen no change in their prices and taxes in the proposed budget. Considering the rise in per capita income, these harmful products will become more affordable.

This would undoubtedly put the low income people, particularly women, into greater health risk.

Currently, more than 50 percent of the country's 37.8 million adult tobacco users use smokeless tobacco products. It is concerning that despite such a large user base, revenues from smokeless tobacco items constitute less than 1 percent of total tobacco revenues.

The government has been losing opportunities of earning additional revenues from this sector. It is impossible to achieve a tobacco-free Bangladesh while giving tobacco companies free passes like this.

“The proposed budget does not reflect any proposals or suggestions from anti-tobacco organizations. The only thing it safeguards is tobacco companies' interests. Once implemented, it will make tobacco products more affordable and increase tobacco-related deaths and other losses. So, we urge the government to incorporate our price and tax proposals in the final budget, ”said PROGGA (Knowledge for Progress) Executive Director ABM Zubair in his reaction to the proposed budget.

Among others, the proposed budget keeps both the existing 45 percent corporate tax on all tobacco companies (cigs, bidis, SLTs) and 2.5 percent Surcharge on tobacco manufacturer's income unchanged.

According to WHO, smokers are more likely to get severely ill from covid-19 infection than non-smokers. Despite all such warnings, the proposed budget failed to make any effort to discourage use of tobacco products for its lack of effective price and tax measures which is utterly frustrating for anti-tobacco activists, they said.

4 years ago