FTAs

Bangladeshi businesspeople in Thailand expect trade boost under Yunus govt

Bangladeshi businesspeople in Thailand believe that the interim government, led by Dr Muhammad Yunus, can explore new avenues for trade and cooperation, unlocking the potential for manpower exports to the Southeast Asian nation through intensified diplomatic efforts.

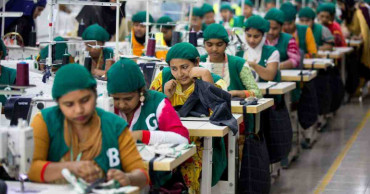

Despite being one of the world's largest exporters of textiles and garments, they said Bangladesh currently exports only about $60 million worth of ready-made apparels annually to Thailand, a country with a clothing demand exceeding $40 billion each year.

Countries such as China, India, Vietnam, Cambodia and Indonesia export significant quantities of garments to Thailand, supported by Free Trade Agreements (FTAs). In contrast, Bangladesh has yet to secure a similar deal that would enhance its RMG product exports to Thailand.

Talking to UNB, Bangladeshi businesspeople also noted that Thailand attracts over 30 million visitors each year and has a substantial labour market for foreign low-skilled workers in sectors such as tourism, agriculture and fish processing.

However, Bangladesh has so far been unable to access this market in its next-door neighbour due to lack of agreements and genuine efforts.

They also said the diplomatic relationship between Bangladesh and Thailand has existed for 52 years, with a flight time of nearly two hours between the two countries. Yet, only around 4,000 Bangladeshis currently reside in Thailand, most of whom are engaged in business, as access to the growing labour market remains limited.

Bangladesh has consistently experienced a large trade deficit with Thailand, which exported over $1.18 billion worth of products to Bangladesh in 2023. Conversely, Bangladesh's exports to Thailand amounted to only $90 million

As Chief Adviser Dr Muhammad Yunus is set to visit Thailand for the Bimstec (Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation) Summit in November, the businesspeople said he can focus on signing the FTA and some other agreements to create scope for exporting manpower in the wealthy country of the Southeast Asia.

“Although Thailand is geographically close to Bangladesh, we have been unable to tap into its thriving business, commerce, and labour market due to a lack of proper diplomatic efforts,” said Kamrul Hasan Rimu, a Bangladeshi engaged in the import and export business in Thailand.

Dr Yunus praises Russian cooperation in power, energy sectors

Rimu, who has been living in Thailand for nearly 40 years since completing his studies at Dhaka University in 1985, said Bangladeshis mostly come to Thailand for personal visits and medical tourism while a very small portion is doing business in the country.

He said five documents—including a Letter of Intent to commence negotiations on a Free Trade Agreement (FTA), as well as Memoranda of Understanding on Energy Cooperation and Tourism Cooperation--between Bangladesh and Thailand were signed during former Prime Minister Sheikh Hasina’s visit on April 26 this year to enhance cooperation between the two nations.

Rimu urged the interim government to prioritise signing the FTAs by intensifying diplomatic efforts, especially given that China and India secured FTAs with ASEAN countries long ago, opening significant opportunities for exporting goods to Thailand with lower tariffs.

“When we import apparels from China and India, we face a 5 percent tax and a 7 percent VAT. But tariffs on Bangladeshi products are 32 percent (25 percent tax and 7 percent VAT), making it challenging to promote many Bangladeshi products in Thailand,” he explained.

Rimu argued that the exports of Bangladeshi products, particularly apparels, could soar if the taxes are reduced from 25 percent to 5 percent through the FTAs.

“There is a considerable demand for T-shirts in Thailand, mostly now imported from China, Vietnam, and Cambodia. Currently, we cannot import T-shirts directly from Bangladesh due to excessive taxes. So, some traders are importing Bangladeshi-made T-shirts via India, using its label,” he said.

He said the prices of T-shirts in Bangladesh are lower than in any other country. “Therefore, Bangladesh has significant potential to capture the T-shirt market in Thailand if the taxes are reduced to 5%.”

Rimu stressed that Bangladesh has an opportunity to tap into Thailand's labour market if an agreement can be reached. “There is scope for Bangladeshis to work in hotels, restaurants, bars, agriculture and fish processing, areas currently dominated by Burmese workers. The minimum wage for these low-skilled jobs exceeds Tk 50,000, which is significantly higher than in Malaysia and many other countries.”

Abdul Quayum, another Bangladeshi businessman residing in Thailand for over three decades, echoed Rimu, noting that the Thai fish processing industry has a demand for foreign low-skilled workers. “With over 30 million visitors annually, foreign workers are involved in various services related to the tourism sector. Thus, Bangladesh should strive to enter the Thai labour market,” he said.

He highlighted Thailand’s goal to increase foreign visitors to 40 million by 2025, which will likely create more job opportunities for foreign workers. “Bangladesh can capitalise on this by signing agreements with Thailand.

Quayum stressed that the visa process for Bangladeshis must be simplified through mutual understanding and agreements, suggesting that the visa-on-arrival facility available in the 1980s could be reinstated.

Mahbub Talukder, known as Don in Pattaya City, shared his experiences as a successful businessman running gift and tailor-made shops.

He pointed out the vast opportunities for Bangladeshis in hotels, restaurants, gift shops and garment stores. “There are also numerous job opportunities in the tourism sector, but the government needs to secure agreements with Thailand to facilitate this,” he said.

Mahbub underscored the importance of branding Bangladesh in Thailand. “Many Thais lack proper knowledge about Bangladesh and its products, often mistaking Bangladeshis for Indians. Effective branding is crucial to enhance bilateral cooperation, trade, and business.”

He suggested that the government could leverage Thailand's experience to develop Bangladesh into another holiday destination for foreigners by improving tourist spots and ensuring necessary facilities.

Read more: RMG workers’ protests disrupt traffic in Dhaka’s Mirpur

1 year ago

Speakers for replicating RMG success model to boost plastic sector

For a sustainable development of plastic sector in post-LDC era, speakers in a webinar have urged to ease duty structure on import of plastic raw materials, modernization of respective policies, encouraging uses of bio-plastic, signing of Free Trade Agreements (FTAs)or Preferential trade arrangements (PTAs) with potential countries.

They sought some initiatives for booming plastic business and attracting foreign direct investment (FDI) on priority basis for increasing negotiation skills to protect the domestic market, bringing product diversification, development of plastic waste management system, technological advancement, enhancing accredited world class testing lab facilities, and innovative product designing.

Speakers put emphasis on these issues at a webinar on “Sustainable export growth in post-LDC world: strategies for the plastic sector” organized by Dhaka Chamber of Commerce & Industry (DCCI) on Saturday.

Principal Secretary to the Prime Minister Dr. Ahmad Kaikaus joined the webinar as the chief guest. DCCI President Rizwan Rahman chaired the event. FBCCI President Md. Jashim Uddin joined as special guest.

Also read: Self-reliance in seed production essential for food security: FBCCI

Dr. Ahmad Kaikaus said that the existing nexus between the public and private sector is stronger than ever that leads Bangladesh to a new height.

In order to identify various prospects and challenges in the plastic sector, he suggested forming a national taskforce combining public and private sector participation.

He also urged for a better plastic waste management solution.

Rizwan Rahman, in his opening remarks said that the plastic sector witnessed a rapid commercialization and became an important export item of Bangladesh.

Export of plastic goods contributes 0.33 percent to the GDP. Around 5,110 companies are operational in the plastic sector and 98 percent of them are SMEs, he mentioned.

“To ensure sustainable industrial growth, a draft Plastic Policy was developed by the Government. Since many preferences will not exist in the post-LDC era, FTA and RTAs can be signed with the potential countries,” the DCCI president said.

“We need to replicate the RMG success model to other export-led manufacturing sectors as well. Product diversification is essential while changing raw materials to recycled plastic waste as a viable alternative,” he added.

Also read: FBCCI to boost business with Mexico

Md. Jashim Uddin, President, FBCCI, Shamim Ahmed, President, Bangladesh Plastic Goods Manufacturers and Exporters Association (BPGMEA), Dr. Md. Shahidul Islam, NBR Member (Customs), Dr. Ijaz Hossain, retired professor of Chemical Engineering, BUET, among others, spoke in the function.

3 years ago

Bangladesh prepares to face challenges after transition from LDC

Bangladesh is focusing on bilateral free and preferential trade deals as a strategy to overcome the possible losses of global trade concessions after its graduation to a developing economy.

Studies on the feasibility of signing Free Trade Agreements (FTAs) and Preferential Trade Agreements (PTAs) with a number of countries have been completed, according to an official document.

Read:TRIPS transition period for LDCs extended by 13 years

The countries and organisations include Malaysia, Vietnam, Thailand, Japan and Eurasian Economic Commission.

The possibility of Bangladesh signing such trade agreements with China, Myanmar, Nigeria, Mali, Macedonia, Mauritius, Jordan, USA, Iraq and Lebanon is also being explored.

Meanwhile, a Comprehensive Economic Partnership Agreement (CEPA) between Bangladesh and India is also on the anvil.

Bangladesh Foreign Trade Institute (BFTI) and Indian Foreign Trade Institute are preparing a report on a joint study on CEPA.

Read Dhaka-Beijing ties can be prime mover for Bangladesh’s transformation: Debapriya

The CEPA is a bit different from FTAs as it covers a lot of issues such as trade in goods and services, investment, intellectual property rights and e-commerce.

Bangladesh has signed a bilateral PTA with Bhutan on December 6, 2020. Under the agreement, 34 Bhutanese products will get duty-free access to the Bangladeshi market and 100 Bangladesh products to get similar access to Bhutan.

The commodities from Bangladesh include baby clothes and clothing accessories, men's trousers and shorts, jackets and blazers, jute and jute goods, leather and leather goods, dry cell battery, fan, watch, potato, condensed milk, cement, toothbrush, plywood, particle board, mineral and carbonated water, green tea, orange juice, pineapple juice, and guava juice.

Read:Dhaka seeks incentive-based package for sustainable graduation of LDCs

The 34 products from Bhutan that will get duty-free access to the Bangladesh market include orange, apple, ginger, fruit juice, milk, natural honey, wheat flour, homogenised preparations of jams, fruit jellies, marmalades, food preparations of soybeans, mineral water, wheat bran, quartzite, cement clinker, limestone, wooden particle boards, and wooden furniture.

Both the countries will be able to increase the number of items gradually through consultation.

PTA negotiations with Nepal are at the final stage.

Read BGMEA discusses export, FDI opportunities with Bangladesh envoy

4 years ago