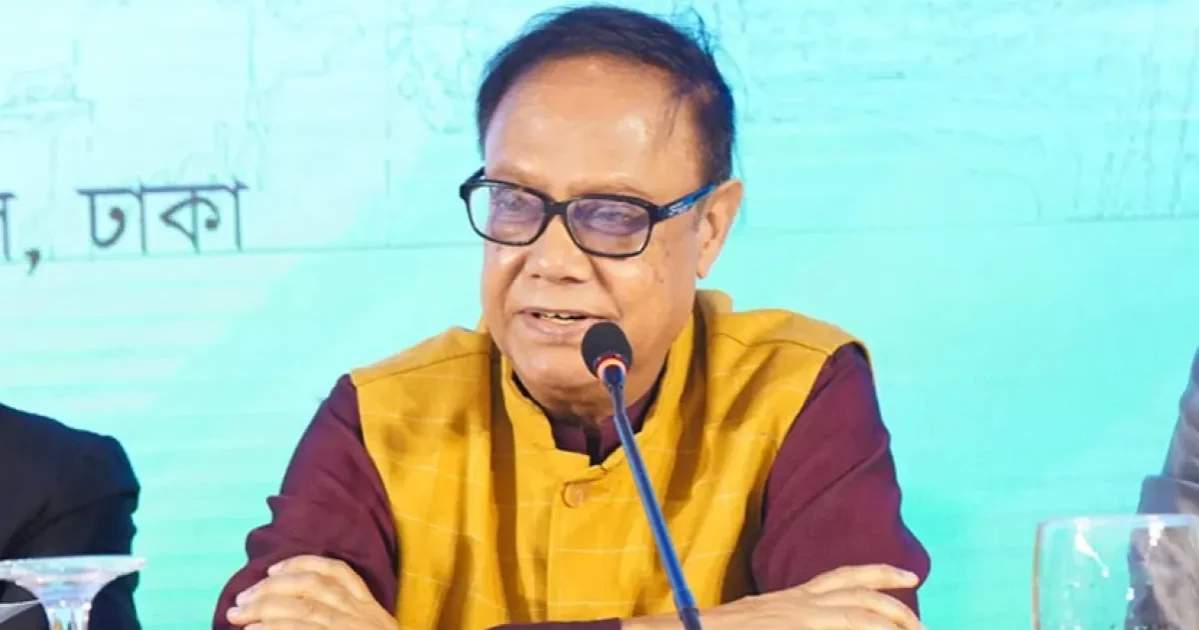

Bangladesh Bank Governor Dr Ahsan H Mansur on Wednesday said that 10 to 15 banks would be enough for Bangladesh’s economy, signalling a major move towards consolidating the nation’s overcrowded financial sector.

Speaking at a seminar titled ‘Banking Sector: Current Challenges and Future Prospects’ at Jagannath University, the Governor revealed plans to reduce the number of state-owned banks to just two through strategic mergers.

“There are currently 61 banks in the country, which is far more than necessary. Considering the reality, 10 to 15 banks are enough for Bangladesh. Reducing the number of banks will make it easier to ensure good governance,” Dr Mansur said.

He delivered a grim assessment of the sector’s current state, pointing out that “malpractice, irregularities, and family-based control” have pushed the banking industry to the brink of collapse.

Dr Mansur estimated that approximately Tk 3.0 lakh crore has been siphoned off from the banking system, with a significant portion likely laundered abroad.

He alleged that between $20 billion and $25 billion was trafficked out of the country through family-controlled banking networks.

“We must be vigilant to ensure that individual-centric decisions no longer influence the banking sector,” he warned, emphasising that urgent reforms are needed at all levels to prevent further deterioration.

Despite these challenges, the Governor expressed optimism that the Non-Performing Loan (NPL) ratio would drop to 25 percent by March. To support struggling institutions, he announced that Bangladesh Bank is working to establish a Bank Resolution Fund with a target of Tk 30,000–40,000 crore, covering both banks and non-bank financial institutions (NBFIs), he said.

Dr Mansur also highlighted the importance of transitioning to a cashless society to combat tax evasion, estimating that such a system could generate an additional Tk 1.5–2.0 lakh crore in annual revenue. He stressed the need to integrate students into the banking network early.

IMF tranche delay posed no threat to Bangladesh’s economy: BB Governor

The Governor warned that political interference in the banking sector remains a risk unless a revised Bangladesh Bank Ordinance is issued.

Jagannath University Vice-Chancellor Professor Dr Rezaul Karim and Economics Department Chairman Professor Dr Sharif Mosharraf Hossain, among others, spoke at the event echoing the need for stricter monitoring and recovery measures in Bangladesh’s fragile banking sector.