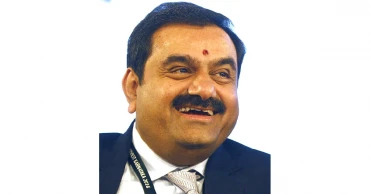

Adani Group

India's Rahul Gandhi accuses PM Modi of favoring Adani Group

India’s top opposition leader Rahul Gandhi on Saturday launched a scathing attack on Prime Minister Narendra Modi and said he was being targeted because he has raised serious questions about Modi's relationship with the Indian business conglomerate Adani Group.

Gandhi said the objective of his expulsion from Parliament on Friday was to prevent him from speaking in the legislature about his allegation of an infusion of an unaccounted $3 billion into shell companies owned by the Adani Group, headed by Gautam Adani.

’’Some of these defense companies are working in drone and missile development and ordnance production. Why is the defense ministry not asking questions,” he said.

Also Read: Indian opposition leader Rahul Gandhi loses Parliament seat

Gandhi was expelled from Parliament a day after a court convicted him of defamation and sentenced him to two years in prison for mocking the surname Modi in an election speech.

The actions against Gandhi, the great-grandson of India’s first prime minister, were widely condemned by opponents of Modi as the latest assaults against democracy and free speech by a ruling government seeking to crush dissent. Removing Gandhi from politics delivered a major blow to the opposition party he led ahead of next year’s national elections.

Gandhi said he was not bothered about losing his seat in Parliament. "My job is to defend the institutions of the country and the voice of people," he added.

Also Read: 'Modi Surname' defamation case: Rahul Gandhi sentenced to 2 years in jail

A court in the western Indian city of Surat also sentenced him to two years in prison on Thursday. But he won’t go to jail immediately as the court granted bail for 30 days to file an appeal against the verdict.

The court convicted Gandhi for a 2019 speech in which he asked, “Why do all thieves have Modi as their surname?” Gandhi then referred to three well-known and unrelated Modis in the speech: a fugitive Indian diamond tycoon, a cricket executive banned from the Indian Premier League tournament and the prime minister.

On Saturday, Gandhi didn't indicate how soon his legal team will approach an appeals court seeking to overturn his conviction so he could save his seat in Parliament.

He accused Modi of helping the Adani Group to get contracts in India, Sri Lanka, and Australia.

Also Read: Test transmission of power supply from Adani plant to Bangladesh's national grid starts

He also alleged that a Chinese national was involved in investments in Adani's shell companies. “Why nobody is asking the question who this Chinese national is,” he said. ”Nobody knows where this money has come from. Adani couldn't generate this money."

Gandhi has demanded a parliamentary committee probe following a report by Hindenburg Research, the U.S. financial research firm, accusing the Adani Group of stock price manipulation and fraud running into billions of dollars. The Adani Group has denied any wrongdoing and the Modi government has not accepted a call for a parliamentary investigation.

Also Read: India’s Supreme Court orders investigation of Adani business group

Soon after Gandhi's news conference, Ravi Shankar Prasad, a top leader of Modi's Bharatiya Janata Party, rejected Gandhi's accusations and said his disqualification from Parliament had nothing to do with the Adani Group controversy.

Since Modi became prime minister in 2014, Adani’s net worth has shot up nearly 2,000% to $125 billion, according to Bloomberg’s Billionaire Index. He surpassed Amazon boss Jeff Bezos to briefly become the world’s second richest man in September after a surge in the value of his seven listed entities.

Also Read: Top policymakers briefed about outcome of meeting with Adani on coal pricing: Sources

Adani’s businesses have won multibillion-dollar contracts to build ports, highways and power plants. The industrialist’s ambitions include developing drones and ammunition, key to the government’s goal of boosting military-related exports to $5 billion while slashing costs for expensive imports.

2 years ago

BNP demands cancellation of power deal with Adani

Terming anti-state the government’s power deal with the Indian Adani Group, BNP on Thursday demanded immediate cancellation of the agreement.

“People of Bangladesh have already received a copy of the contract with Adani Group. This is an extremely uneven deal signed with an ulterior motive,” said BNP Secretary General Mirza Fakhrul Islam Alamgir.

Speaking at a roundtable discussion, he said the question has now arisen in different countries of the world about how a government can ink such an agreement as the Washington Post exposed the Bangladesh government’s power agreement with the Adani group.

“This agreement with Adani is against the country and its people. I would like to say this deal must be repealed immediately. At the same time, the indemnity act for the power sector should be revoked,” he said.

Association of Engineers Bangladesh (AEB) arranged the programme titled “Catastrophe in the Power Sector: Economy in Deep Crisis” at a city hotel. AEB secretary general Engineer Hasin Ahmed delivered the key-note speech.

Fakhrul said the Awami League government could sign the deal with Adani as it has no compassion and responsibility for the people of Bangladesh. “This government has also no accountability to the people of Bangladesh. They steal money and siphon off it abroad to build houses, do business and live a life of luxury by cutting the pockets of our common people."

Read more: Power deal with Adani Group unnecessary, uneven: Fakhrul

He said the ruling party leaders are also plundering public money to use it during the next general election to ensure their victory as they did during the 2018 polls.

“They’ll again rig the election with money. They’ll give money to various institutions involved in conducting the election... envelopes containing money will go to all levels from the presiding officers to the police, BGB, and even those who will act as the striking force. This is true as it happened in 2018," the BNP leader said.

He said they have come to know that the government is making a new strategy to use the members of Ansar and VDP to rig votes in the next polls.

The BNP leader said the government has also been using a new strategy in the local body polls for ensuring the victory of the ruling party candidates by changing the results of different centers. “(Monirul Haque) Sakku of Cumilla is one of such victims”

Dr Zafrullah for repealing ‘anti-state’ power deal with Adani Group

2 years ago

India’s Supreme Court orders investigation of Adani business group

India’s Supreme Court today ordered an expert committee to investigate any regulatory failures related to the country’s second-largest conglomerate, the Adani Group.

The investigation was prompted by allegations made by U.S. short-seller Hindenburg Research in a report that accused Adani companies of engaging in market manipulation and other fraudulent practices.

Shares in the group’s flagship, Adani Enterprises, and other affiliated companies have lost tens of billions of dollars in market value since Hindenburg issued its report.

The Adani Group has denied any wrongdoing, defending itself against the allegations in a 413 page rebuttal. In a tweet Thursday, it welcomed the court order.

``It will bring finality in a time-bound manner. Trust will prevail,” the company said.

The expert committee will submit its findings to the Supreme Court within two months, said Chief Justice D.Y. Chandrachud and justices P.S. Narasimha and J.B. Pardiwala.

The top court also directed the government-run Securities and Exchange Board of India to investigate whether there had been a violation of rules or manipulation of stock prices by the Adani Group.

The court acted on petitions filed by some activists and lawyers.

Apart from investigating allegations against Adani, the expert committee is to suggest measures to improve regulatory oversight and protections for investors.

Adani Enterprises canceled a share offering meant to raise $2.5 billion last month after Hindenburg issued its report and its share price plummeted.

Opposition lawmakers blocked parliamentary proceedings last month demanding a probe into the business dealings of coal tycoon Gautam Adani, who is said to enjoy close ties with Prime Minister Narendra Modi.

3 years ago

TIB for reviewing Dhaka's power purchase deal with Adani Group

Transparency International Bangladesh (TIB) on Friday asked the Bangladesh government to reconsider and if necessary cancel what it calls the vague and inequitable power purchase agreement with Adani Group.

“TIB expressed deep concern that the Bangladesh's power sector may become hostage to this controversial company if the unequal, opaque and discriminatory contract signed by Bangladesh Power Development Board to purchase 1600 megawatt electricity from India's Adani, which is an accused of share fraud, is implemented,” said a press release.

This organization suggested bringing applicable amendments to this agreement after reviewing its terms thoroughly by engaging experts, or if necessary scraping the agreement for the sake of the national interest especially considering that the final burden of this agreement should be borne by the people of the country.

Read more: Amid standoff over tariff, transmission lines for electricity from Adani plant completed

According to national and international media reports, the electricity generated from the Adani power plant located in Godda, Jharkhand will cost almost three times more than the electricity produced in the country. Again, there is an obligation in the power purchase agreement (PPA) to buy power from Adani Power at this high price, it said.

TIB Executive Director Dr. Iftekharuzzaman said this agreement is considered as inequitable and unclear and unprecedentedly discriminatory contract for Bangladesh by the international reliable analysis.

“It seems that the agreement has ignored the interests of Bangladesh and favored the interests of Adani group in such a way that the electricity sector of Bangladesh can become a hostage in the hands of this company. This burden will have to be borne by the people of this country,” he said.

3 years ago

Indian tycoon Adani hit by more losses, calls for probe

Losses for the troubled Adani Group, India's second-largest conglomerate, deepened on Friday as shares in its flagship company tumbled another 25%, extending over a week of declines that have wiped out tens of billions of dollars in market value.

The debacle, which led Adani Enterprises, the group's flagship company, to cancel a share offering meant to raise $2.5 billion, has drawn calls for regulators to investigate after a U.S. short-selling firm, Hindenburg Research, issued a report claiming the group engages in market manipulation and other fraudulent practices. Adani denies the allegations.

Opposition lawmakers blocked Parliament proceedings for a second day Friday, chanting slogans and demanding a probe into the business dealings of coal tycoon Gautam Adani, who is said to enjoy close ties with Prime Minister Narendra Modi.

The government has remained silent. A Finance Ministry spokesperson told The Associated Press there were no plans for any comment. Amit Malviya, the governing Bharatiya Janata Party’s information and technology chief, said in a television interview that the opposition was using Adani’s crisis to target the Modi government and that “regulators are looking into” what happened.

India’s market regulator, the Securities and Exchange Board of India, also has not commented. The Economic Times newspaper reported, citing unnamed sources, that the agency had asked stock exchanges to check for any unusual activity in Adani stocks.

Shares in Adani Enterprises fell as much as 30%, to 1,017 rupees ($12) Friday before recovering to trade about 15% lower. The company's share price has plunged by about 66% since Hindenburg released its report last week, when it stood at 3,436 rupees ($41). Stock in six other Adani-listed companies were down 5% to 10% on Friday.

Adani, who made a vast fortune mining coal and trading before expanding into construction, power generation, manufacturing and media, was Asia's richest man and the world's third wealthiest before the troubles began with Hindenburg's report.

Read more: Adani cancels a $2.5 billion share offer after stock fraud allegations

By Friday, his net worth had halved to $61 billion, according to Bloomberg’s Billionaire Index, where he dropped to the 21st spot worldwide.

He has said little publicly since the troubles began, though in a video address after Adani Enterprises cancelled its already fully subscribed share offering he promised to repay investors. The company has said it is reviewing its fundraising plans.

Hindenburg's report said it was betting against seven publicly listed Adani companies, judging them to have an “85% downside, purely on a fundamental basis owing to sky-high valuations.” Other allegations in the report included concerns over debt, use of offshore shell companies to artificially raise share prices and past investigations into fraud.

Adani's speedy, debt-led expansion in recent years caused his net worth to shoot up nearly 2,000%. Even before last week, critics said his ascent was aided by his apparent close ties to Modi and his government. Analysts say he has been successful at aligning his priorities with that of the government by investing in key sectors, but point out that he also has major infrastructure projects in states that are ruled by opposition parties

3 years ago

BPDB seeks revised agreement with Adani before importing power from Jharkhand plant

The government has sought a revision to the power purchase agreement (PPA) it signed with Adani Power Ltd for importing electricity from its thermal power plant in Jharkhand, India.

Bangladesh Power Development Board (BPDB), the government agency tasked with overseeing the development of the country’s power sector, has already sent a letter to the Indian company in this regard, according to officials familiar with the deal.

It seems the price of coal to be purchased as fuel for the project has emerged as the prime bone of contention.

“We have sent a letter to the Adani Group following a request we received in relation to opening LCs (in India) to import the coal that will be used as fuel for the 1,600 MW plant in Jharkhand,” a highly-placed official of BPDB told UNB, in return for anonymity to discuss the sensitive matter.

Read: BPDB staring at 80% jump in annual losses after gas price hike

Since practically all the power generated by the plant located in the Godda district of Jharkhand state will be exported to Bangladesh, Adani Power requires a demand note from BPDB that it can present to Indian authorities before opening LCs against the coal import.

The cost incurred to import the coal, including transport from port to plant, will ultimately be borne by Bangladesh, with the price factored into the PPA's tariff structure.

Adani Power recently sent a request for BPDB to issue the demand note, where the coal price is quoted at $400 per metric ton (MT) - far above what BPDB officials believe it should be given the present state of the international market.

“In our view, the coal price they have quoted ($400/MT) is excessive - it should be less than $250/MT, which is what we are paying for the imported coal at our other thermal power plants," the official said.

Read: The Tk 700 crore per month hole in the deal with Adani Power

The same sources also said Bangladesh’s stance on the issue was communicated to Adani Power officials during the visit of a delegation led by State Minister for Power, Energy and Mineral Resources Nasrul Hamid to the site of the power plant, that took place in the first week of January.

Publicly however, the state minister gave no indication of any such issue during the visit, instead telling reporters that Bangladesh would start importing the power generated by one of the two units at the plant, some 750 MW, from March.

The subsequent letter counts as BPDB’s formal request for the PPA to be reviewed and tariff structure to be adjusted before it can start importing the electricity, officials said.

No discounts, please?

A number of BPDB officials told UNB it was the absence of a provision for discounts on the purchase of coal in the PPA signed with Adani Power, that allowed the Indian firm to quote such a steep bill for the coal.

Read: CPD raises question about power tariff enhancement proposal

The absence of such a provision is all the more notable since it was made mandatory in the PPAs for thermal power plants signed with other independent power producers, domestic or foreign. In these PPAs, the price of coal to be purchased as primary fuel was kept as “pass-through”.

The PPA with Adani Power was signed in November 2017, in Dhaka. Then-Power Division Joint Secretary Faizul Amin, BPDB secretary at the time Mina Masuduzzaman and Adani’s Business Development President Kandarp Patel signed two documents - the PPA and an Implementing Agreement - on behalf of their respective sides.

Interestingly, reports in Bangladeshi media from the time suggest the agreement had to be rushed through in the end, on the insistence of the Indian company. A date proposed by the Power Division had to be brought forward, reported Energy and Power magazine, as the Indian company ‘was insisting to sign the deal earlier’.

Most of the top and senior officials of the Power Division were unable to attend, the report adds. Did this rush to sign ‘ahead of schedule’ in the end cause the absence of the discount provision to be missed?

Read More: Power tariff further raised at both bulk and retail levels, effective from tomorrow

Incidentally the coal for the project, it is now known, will be purchased from the Adani-owned Carmichael mine in Queensland, Australia.

Normally, the price of coal is calculated on the basis of the Newcastle Price Index, with purchases of high quantities or with higher calorific values enabling the buyer to avail discounts of upto 55 percent on the bulk value.

For example, the provision is present in the PPA for the 1320 MW Payra power plant, a Bangladesh-China joint venture where BPDB is benefiting from discounts on coal purchases. The amount of coal required to operate these plants typically runs into the millions of tonnes.

The annual requirement of coal for the Godda plant is estimated to be 7-9 million tonnes. But given the omission of a discount provision, Bangladesh will ultimately end up paying Adani Power Tk 20-22 per unit of electricity, once all the hidden costs are piled on top of the tariff.

Read More: Retail gas prices hiked for power plants, industries and commercial users with effect from Feb 1

"Compare that to the price it pays for the electricity bought from coal-fired plants in Bangladesh, which is below Tk 12 per unit," the senior BPDB official said.

He and others insist that if Adani doesn’t agree to adjust the pricing mechanism for coal in the PPA, it would be simply unviable for Bangladesh to import power from the Godda power plant.

As per Power Division documents seen by UNB, Bangladesh would be paying Adani Power an estimated $23.87 billion, equivalent to almost Tk 240,000 crore (considering US dollar exchange rate at Tk 100), over the 25-year life cycle of the plant, if the PPA remains unchanged.

Adani Power’s investment in the plant, including transmission lines till the Bangladesh border, have been estimated at around $2.1 billion.

Read More: Adani’s 750 MW power to come to national grid in March: Nasrul Hamid

3 years ago

Adani Group mulls suing US short-seller for fraud claims

India’s Adani Group launched a share offering for retail investors Friday as it mulled taking legal action against U.S.-based short-selling firm Hindenburg Research for allegations of stock market manipulation and accounting fraud that caused heavy selling of its stocks this week.

Jatin Jalundhwala, head of the Adani group’s legal department, said late Thursday that the group “was evaluating the relevant provisions under U.S. and Indian laws for remedial action against Hindenburg Research.”

``Clearly, the report and its unsubstantiated contents were designed to have a deleterious effect on the share values of Adani Group companies as Hindenburg Research by their own admission, is positioned to benefit from a slide in Adani shares,” Jalundhwala said.

Read more: Adani’s 750 MW power to come to national grid in March: Nasrul Hamid

Hindenburg’s report has prompted investors to dump Adani Group shares, wiping out billions of dollars' worth of market value.

Jalundhwala said the allegations were an attempt by Hindenburg to sabotage Adani’s share offering. Hindenburg Research said in a rebuttal that it would welcome legal action by the Adani group.

“We fully stand by our report and believe any legal action taken against us would be meritless," it said in a statement.

Adani made a vast fortune mining coal as energy-hungry India grew swiftly after its economy was liberalized in the 1990s. Businesses in the conglomerate span industries including construction, data transmission, media, renewable energy, defense manufacturing and agriculture.

The market value of Adani's companies has soared in recent years, one of the reasons Hindenburg said it judged the seven key Adani listed companies to have an “85% downside, purely on a fundamental basis owing to sky-high valuations.”

Its report, “Adani Group: How the World's 3rd Richest Man is Pulling the Largest Con in Corporate History," said Hindenburg was betting against shares in companies within the Adani empire, founded by Asia’s richest man, coal magnate Gautam Adani.

Hindenburg said its report followed a two-year investigation and “listed 88 questions it invited the company (Adani) to answer." Most of the allegations involved concerns about the group's debt levels, activities of its top executives, use of offshore shell companies and past investigations into fraud. So far, Adani had answered none of these questions,’’ it said.

Adani set a price range of 3,112 rupees-3,276 rupees ($38.22-$40) a share for the offering, which closes on Tuesday. Shares in the flagship company Adani Enterprises fell 10% to 3,060 rupees at one point on Friday. Its shares fell 1.6% on Wednesday. Indian markets were closed Thursday for a holiday.

Read more: Forbes Real-Time Billionaires List: India’s Gautam Adani overtakes Jeff Bezos again

Some of the companies suffered even bigger hits.

Shares in Adani Transmission plunged 19.4% on Friday after sinking 8.1% on Wednesday. Adani Ports and Special Economic Zone Ltd. sank 17.3% on Friday after shedding 6.1% on Wednesday. Other group companies fell between 5% to 20%.

3 years ago

Adani’s 750 MW power to come to national grid in March: Nasrul Hamid

The electricity of Indian Adani Group’s Jharkhand power plant will cost Tk 22 per unit as import to Bangladesh is expected to start from March this year, according to a Power Division media statement issued on Tuesday (January 03, 2023).

State Minister for Power, Energy and Mineral Resources Nasrul Hamid visited the Jharkhand power plant on Tuesday.

Power secretary Habibur Rahman and BPDB chairman Mahbubur Rahman accompanied the state minister during the visit.

During the visit, Nasrul told reporters that Bangladesh will receive the electricity from March this year for which a dedicated transmission line has been installed.

Read more: The Tk 700 crore per month hole in the deal with Adani Power

“Power import from the Adani’s Jharkhand plant will be possible from March”, a Power Division media statement quoted him as saying.

“Initially we’ll get about 750 MW from the plant. We need more electricity to meet our demands in the coming summer”, it said.

Adani's Jharkhand coal-fired power plant will have a total of 1,600 MW capacity from two units, each having 800 MW.

“We’re looking for alternative sources of energy. We’ve been working giving priority on uninterrupted power supply at affordable prices”, Nasrul said.

Read more: Introduce smart management system in power grid: Nasrul Hamid

The Adani Group, very close to Indian Prime Minister Narendra Modi, set up the 1600 MW power plant in India’s eastern state of Jharkhand under a deal signed on November 5 in 2017 to export its entire electricity to Bangladesh.

Power Grid Company of Bangladesh (PGCB) constructed two substations at Chapainawabganj and Bogura in Bangladesh and also a transmission line to import the electricity.

Meanwhile, officials of the BPDB are concerned about the tariff of the imported electricity from the Jharkhand plant as its cost will be almost double of the electricity to be generated from locally installed Payra power plant, a joint venture of Bangladesh and China.

They said Bangladesh will incur a huge financial loss to the tune of about Tk 700 crore per month, once it starts importing electricity from the Adani 1,600 MW thermal power plant in Godda, Jharkhand state - due to the ‘flawed’ deal the government signed with the private Indian company.

Read More: Pay production cost to get smooth supply of gas, electricity: PM Hasina tells industries

“Including the cost of coal and its transportation, we have to pay Tk 2,100 crore per month to import 1,600 MW from Adani's plant at a 75 percent plant factor considering the existing rates of coal in the international market," a top official of the state-owned BPDB told UNB.

If some rules and provisions observed in other similar deals (from the private sector, coal-fired) had been maintained here, the cost could have been kept down to Tk 1400 crore per month. The country has to count a loss of about Tk 700 crore per month, working out to Tk 8400 crore annually for the flaws in the deal, he added.

Over the project’s life cycle of 25 years, the loss in terms of the increased cost and hidden components in the tariff Bangladesh will ultimately incur Tk 2.10 lakh crore - a third of the national budget - considering the current coal price, the senior official noted.

The BPDB official said the lack of a provision for discounts in the purchase of the coal that will be used to fuel the plant is an oversight, considering such a provision was made mandatory in other deals that Bangladesh signed with independent power producers (IPP), where the price of coal to be purchased was kept as “pass-through”.

Read More: Ensuring access to electricity at an affordable cost is govt’s prime goal: PM’s Energy Advisor

Explaining the matter, he said Adani will purchase the coal for its power plant as primary fuel and Bangladesh will pay the price of the coal.

Normally, the coal price is calculated on the basis of the Newcastle Price Index, and if any company purchases coal at a higher quantity with higher calorific value, then it gets upto 55 percent discount on the bulk value.

This was the provision kept in the power purchase deal from the 1320 MW Payra power plant, a joint venture project of Bangladesh and China, where BPDB is benefiting from the discount in the price of coal.

“But BPDB will not get any discount in coal price which ultimately pushes up the electricity tariff from the Adani plant by at least 50 percent,” said the official who has been involved in handling the project from BPDB.

Read More: Electricity generation disrupted as Kaptai Lake’s water level decreasing

As a result, if the price of electricity from Bangladesh's Payra Power Plant is calculated at Tk 12-13 per unit including the cost of coal, the price of per unit electricity from Adani plant will be about double at Tk 20-22 per unit, he added.

3 years ago